Gifts That Protect Your Assets

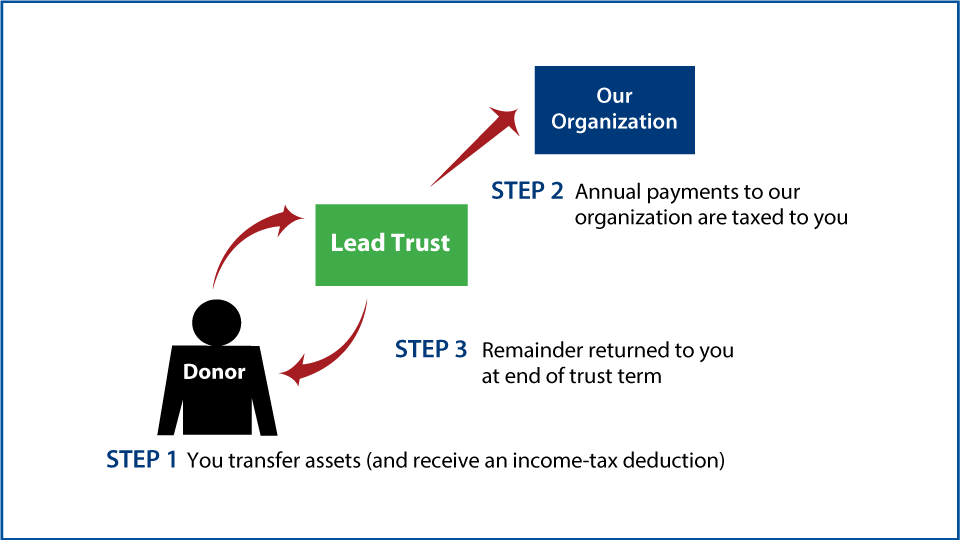

This type of gift arrangement allows you to direct gifts to the Navy League for a specified period of time and, in turn, receive either a charitable deduction now for gifts made in subsequent years or a reduction in gift or estate taxes on property you wish to pass to heirs.

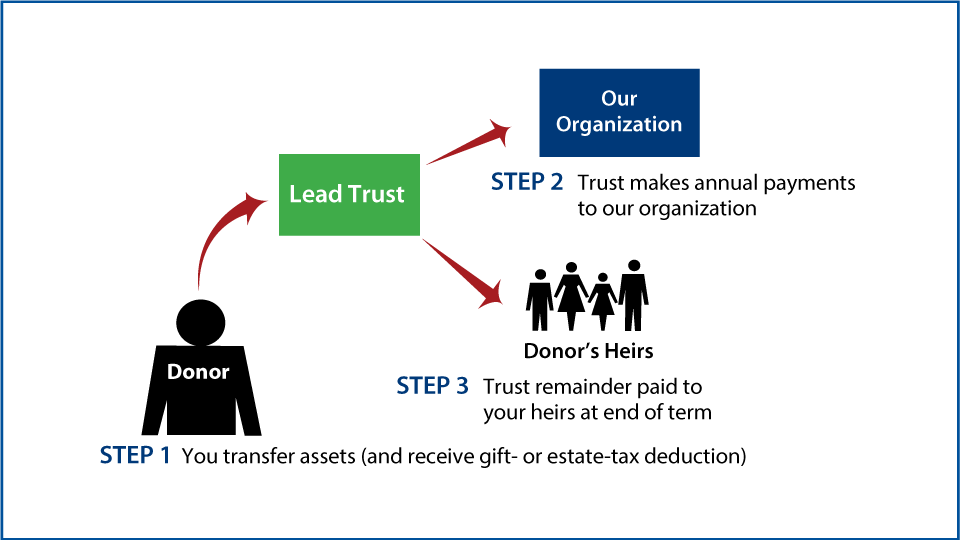

Under the nongrantor plan, you irrevocably transfer assets to a trustee and provide that payments be made to Navy League of the United States for a certain number of years (or until the end of your or another's life). Then the principal is distributed to your children, grandchildren, or other heirs. The principal passes to your heirs at greatly reduced gift- and estate-tax rates and sometimes escapes them altogether. The charitable lead trust may appeal to individuals who wish to make a gift but retain the property in their family.

Charitable lead trusts (CLTs) are simple in concept but are complex gift- and estate-planning devices because of the many technical drafting requirements of the IRS. We recommend you consult an attorney who specializes in trusts and estates and has experience with CLTs.

There are two types of charitable lead trusts: the grantor lead trust and the more popular nongrantor lead trust, which was made famous by the late Mrs. Jacqueline Kennedy Onassis.

Most donors who use CLTs to accomplish their philanthropic and estate-planning objectives opt to create a qualified CLT. Many requirements must be met for a CLT to be qualified, but here are a few major considerations:

- The payments (gifts) to the Navy League must be an annuity interest (fixed-dollar amount annually) or unitrust interest (fixed percentage of the fair-market value of the trust assets determined annually). There are no minimum or maximum payout rates.

- The term of the trust (the number of years in which gifts will be made) must be measured by the life or lives of a person or persons living when the trust is created or a specified number of years.

- The charitable beneficiary must be an organization described in the appropriate sections of the IRS Code. Navy League of the United States is a qualified charitable organization.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Legal Disclaimer

The Navy League is an exempt organization, duly qualified under Section 501(c)(3) of the Internal Revenue Code, contributions to which are tax deductible in accordance with federal law.

If your donation is for a scholarship, the Navy League Foundation is a 501(c)(3) organization: Federal Tax ID 31-1677884.