Gifts That Pay You Income

Do you want to support Navy League of the United States but worry about having enough income for yourself and your loved ones? Life-income gifts such as gift annuities and charitable remainder trusts can provide donors with an income stream, significant tax savings, and the satisfaction of providing the Navy League with vital long-term resources.

The creation of a life-income gift benefits both the giver and the receiver—a "win-win" situation. The following life-income gifts are available, and one may be right for you:

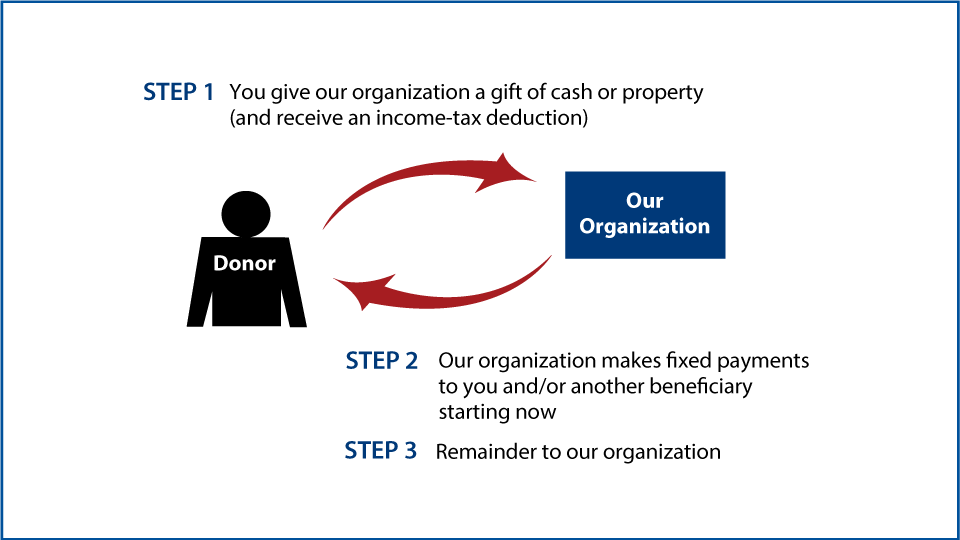

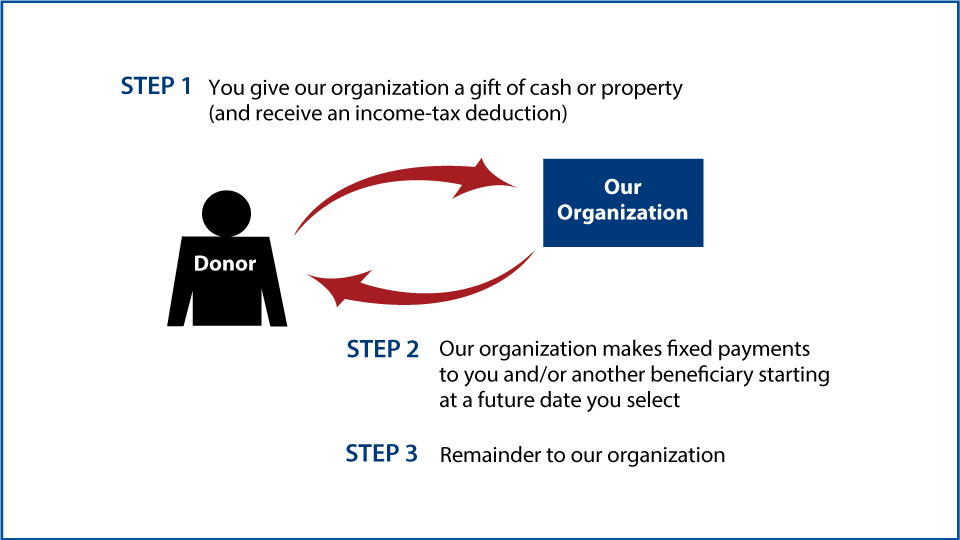

Charitable Gift Annuities

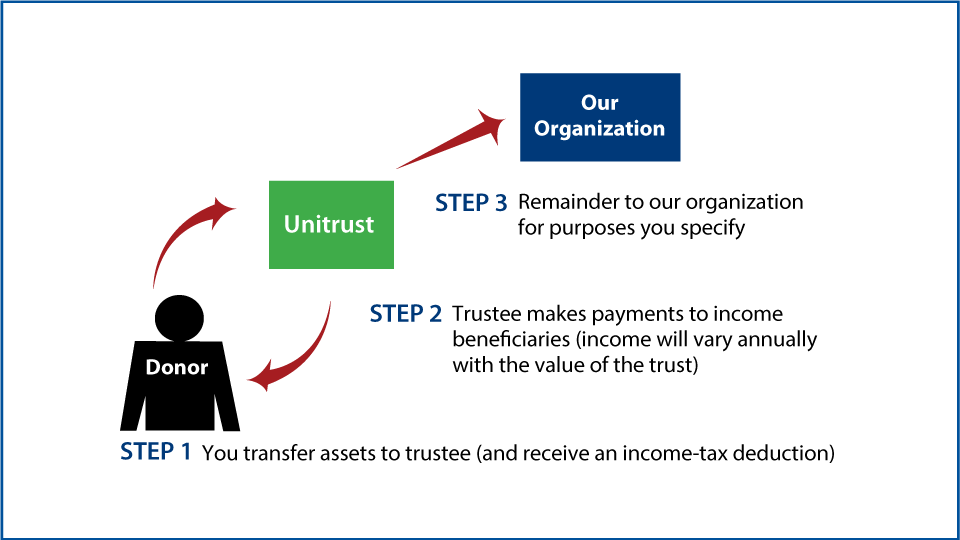

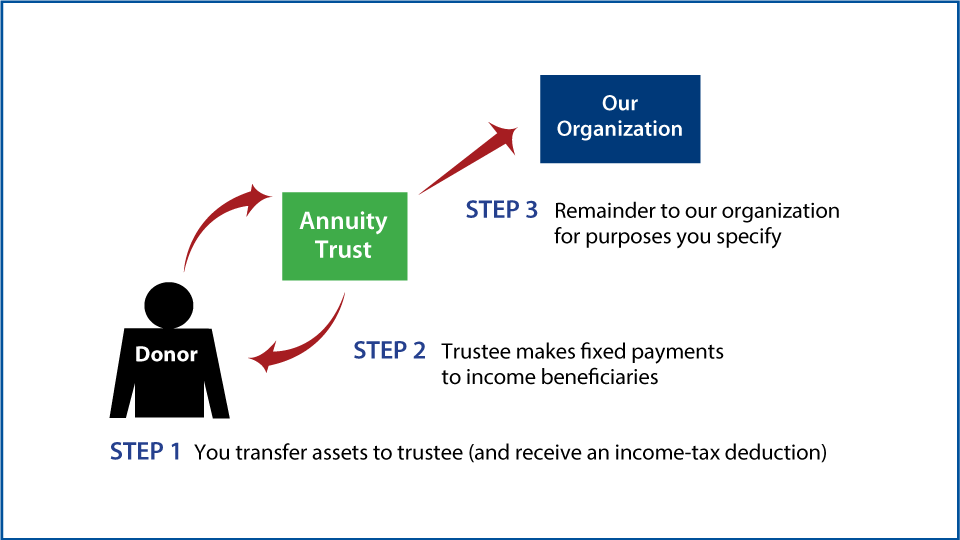

Charitable Trusts

The information contained herein is offered for general informational and educational purposes. The figures cited are accurate at the time of writing. State law may affect the results illustrated. This is not legal advice. Any prospective donor should seek the advice of a qualified estate and/or tax professional to determine the consequences of their gift. Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Legal Disclaimer

The Navy League is an exempt organization, duly qualified under Section 501(c)(3) of the Internal Revenue Code, contributions to which are tax deductible in accordance with federal law.

If your donation is for a scholarship, the Navy League Foundation is a 501(c)(3) organization: Federal Tax ID 31-1677884.