Gifts from Retirement Plans

Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

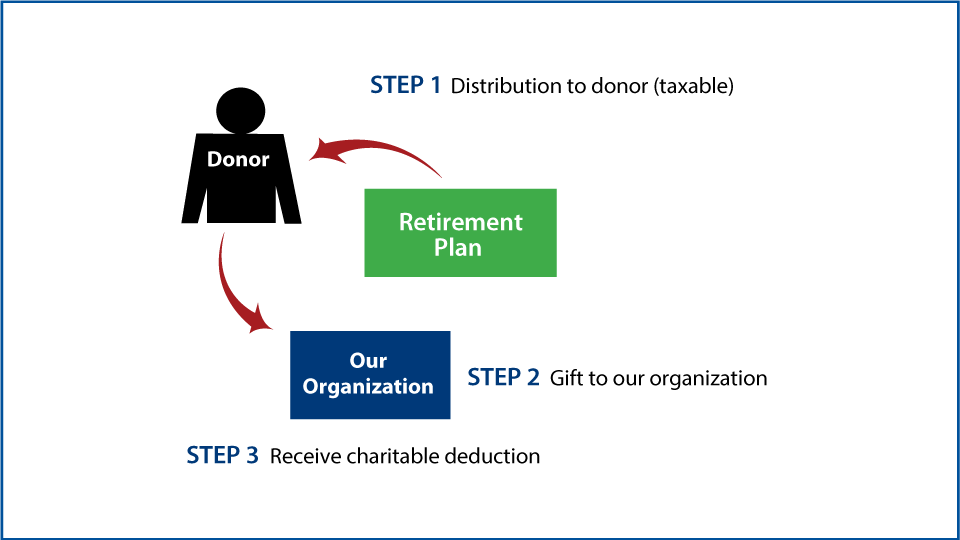

Lifetime Gifts  Click to See Diagram |

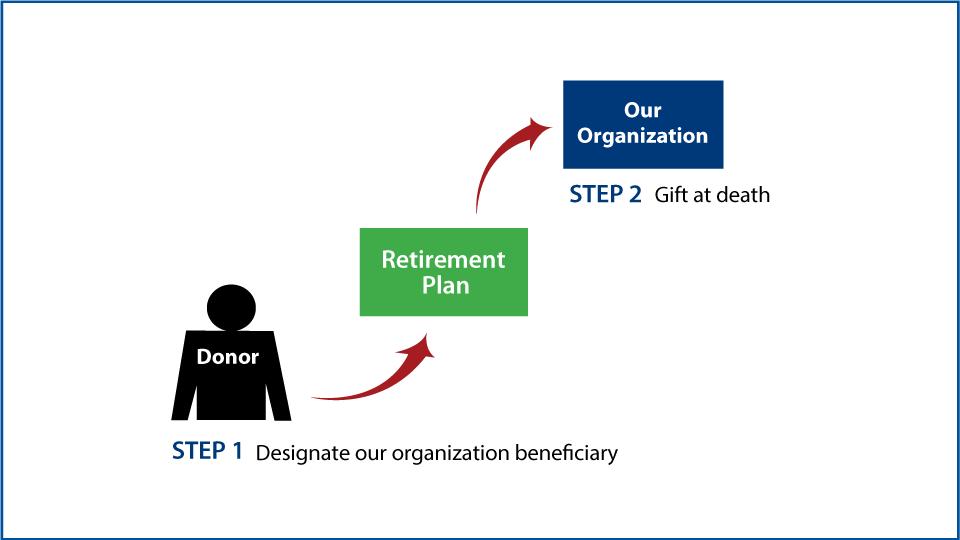

Estate Gifts  Click to See Diagram |

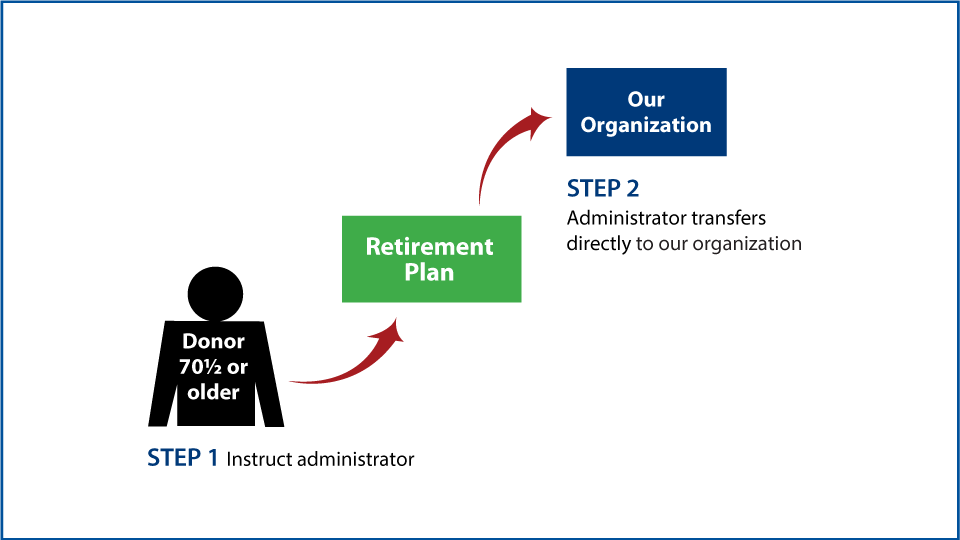

“IRA Rollover” Gifts (QCD)  Read More |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Legal Disclaimer

The Navy League is an exempt organization, duly qualified under Section 501(c)(3) of the Internal Revenue Code, contributions to which are tax deductible in accordance with federal law.

If your donation is for a scholarship, the Navy League Foundation is a 501(c)(3) organization: Federal Tax ID 31-1677884.